The intersection of finance and technology, which has given rise to the term “fintech,” creates opportunities for businesspeople to pioneer new approaches.

Since the discovery of the abacus, which simplified financial calculations, until the development of the massive supercomputers that are employed to push complex financial prototypes today, innovation and financial services have been intricately intertwined with one another. This merger resulted in the birth of the fintech industry, and today the vast majority of financial transactions are completed on mobile devices, making it possible for a greater number of individuals to have access to various financial products.

Aside from expanding access, technology has also been the driving force behind a wide variety of significant changes to the economic systems all over the world, and in some cases, it has turned entire industries on their heads, such as in the instance of mobile investment apps and stockbrokers. Nevertheless, the revolution in financial technology is ongoing, and the following are among the most important trends that will influence the future of financial services. These trends are being driven by innovative businesspeople.

Security

As the domain of face-to-face connections in financial products has given way to interactions conducted remotely, security has emerged as one of the most pressing issues that all parties involved have been forced to address. The rate of cybercrime has been steadily increasing at a startling rate, and the cost of ransomware payouts is progressively becoming an ordinary operating cost for many businesses.

Because biometric indicators cannot be reproduced or hacked, there is a growing emphasis on biometric alternatives as a means of attaining the highest possible security levels. This is done to combat the previously mentioned issue. The use of fingerprints as the primary form of biometric identification has been the norm up until recently; however, public health issues are now moving focus to non-contact biometrics identity alternatives as well.

Accessible Banking

In the past, banking firms have been very protective of their customer’s personal information to maintain their competitive edge. In most cases, this has entailed blocking access to competitive rivalry, but it has also frequently resulted in banks rejecting clients’ full control over the information they have collected about themselves. Open banking is experiencing a renaissance in modern times not only as a result of the proliferation of data safety laws that enables clients to access and transfer their information in any manner they see fit but also as a consequence of the growing collaboration between fintech firms and conventional banking institutions.

It is estimated that open banking produced $7.29 billion in 2018, and its total revenue is projected to reach $43.15 billion by the year 2026. Open banking provides new fintech businesses with the ability to utilize big data to offer better — and more personalized — services to customers. These improved services assist individuals in reducing their debt, increasing their earnings, and making decisions regarding investments that are more likely to be profitable.

Regtech

As financial technology firms have continued to develop solutions based on new technology, governments, and their government regulators all over the globe have been playing catch-up by developing new policies and procedures to encompass each innovative development in the industry. Because of this, financial technology firms now have to contend with a disparate set of laws in each nation in which they conduct business.

Regulatory reporting, the surveillance of money transfers and the risks involved with them, and identity authentication are the three primary categories into which regtech solutions can usually be categorized. The method of determining which regulations are applicable and cooperating with them should be made easier by using any one of the available regtech solutions. The value of the regtech industry is projected to increase from 6.3 billion in 2020 to 16.0 billion by 2025, registering an annual compounded growth rate (CAGR) of 20.3% throughout this forecast period.

Utilization of Cryptographic Currencies

In contrast to the early days of cryptocurrency, when the technology was still on the periphery, conventional financial services firms increasingly adopted the technology in 2020. For example, in November, PayPal announced that it would start enabling all consumers based in the United States to purchase, hold, and purchase cryptos on its platform.

As more individuals start using cryptocurrencies, a greater number of businesses will start accepting them as payment. Businesses that can offer solutions to the challenges that virtual currencies present, such as safety and unpredictability, will be compensated by the market. Virtual currencies have their benefits, but they also have their disadvantages.

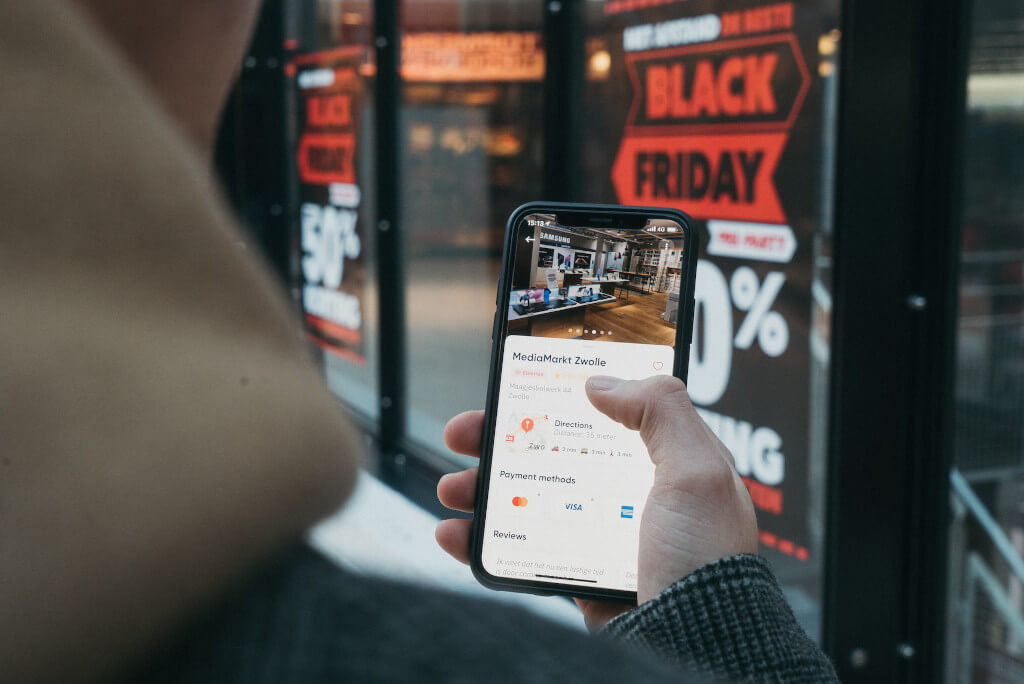

Smartphone Payments

It’s not too late for cash. Yet. However, it is abundantly clear that it is on its way out as the world moves away from direct physical contact and more options for making payments via mobile devices become commonly accessible. Contactless wallets have quickly become an important focus for businesses in the financial sector, from fledgling enterprises to established corporations such as Apple and Google.

It is not uncommon to find solutions that simplify the process of transferring money; however, international transfers continue to be a significant source of the difficulty. Even though Transferwise has raised $319 million at a pricing of $5.5 billion and other fintech firms have brought up significant amounts of money as well, there remains a long way to go until international payments are as streamlined as local ones. The potential for profit in contactless banking is growing concurrently with the size of the marketplace for money transfers, which is continuing to expand.

AI Technology will Push Huge Value Creation

It is anticipated that the application of artificial intelligence (AI) will be able to add one trillion dollars in annual value to the banking industry worldwide. It is anticipated that financial institutions such as banks will move toward adopting an AI-first mentality, which will start preparing them to withstand incursion onto their territory by growing technology companies.

Automatic factor discovery, also known as the machine-based identification of the factors that contribute to outperformance, will become increasingly widespread in the financial services industry. This will assist in the improvement of financial modeling throughout the sector. Knowledge graphs and graph computing will play an increasingly important role as key applications of artificial intelligence semantic representation. Their capacity to aid in constructing affiliations and making comparisons across complicated financial channels, pulling on a broad range of frequently unrelated datasets, will have significant ramifications in the years to come.

In conclusion, analytics that includes improved privacy laws will encourage limited data usage, which refers to the utilization of data that is only pertinent, essential, and adequately sterilized to develop financial projections. These include federated learning, a type of fragmented machine learning that outlines the threat to confidentiality affiliated with consolidating data sources by attempting to bring the computer resources to the data instead of vice versa.

This type of learning brings computational power to the data rather than the other way around. A new frontier in consumer safety will be driven by the development of technologies such as sophisticated encryption, safeguard multi-party computing, zero-knowledge verification, and other confidentiality tools for data analysis.

AI in The Financial Industry

Applications of AI will soon permeate the entire spectrum of operations carried out within the financial industry, including front, middle, and back offices. Consumer applications include substitute credit ratings based on non-monetary data and image recognition authentication in addition to customized solutions, personalized user experiences and advanced analytics, smart robotic systems and chat interactions, market tracking systems, automated money transfers, and robo-advisors. Applications for the middle and back office include things like intelligent processes, improved tools for the representation of knowledge (best exemplified by knowledge graphs), and organic linguistic processing for fraud detection.

The application of artificial intelligence (AI) in many financial institutions is still inconsistent and haphazard, with the technology typically being limited to particular use cases or verticals. However, the most successful companies in the banking industry are revolutionizing their operations by systematically integrating AI into every stage of the digital product lifecycle. Notably, the financial sector is beginning to comprehend that the quality of an algorithm is directly proportional to the data that it uses.

The focus is shifting toward gaining a competitive advantage from data collected about customer behavior through more traditional methods, which have been underutilized in the past. Because of this, the potential of ecosystem-based financing, in which financial institutions such as banks, insurers, and other financial services companies collaborate with non-financial players to effective communication and collaborate on consumer experience in areas that fall outside of their conventional purview, will be unlocked.

The “AI-first” institution will lead to improved operational excellence for banks as a consequence of the severe automated processes of daily labor (a mindset known as “zero-ops”) and the substitute or modernization of individual choice by sophisticated diagnostic tests. This will be accomplished through the implementation of AI. The broad adoption of conventional and cutting-edge AI technologies, such as machine learning and face recognition, to the assessment of large and intricate customer information sets in (near) real-time, will lead to enhanced operating efficiency.

This improvement will circulate from the broad use of these technologies. The financial institutions of the future will embrace the speed and flexibility appreciated by “digital native” users and businesses. These banks will be known as “AI-first” banks. They will invent things at a breakneck pace, introducing new capabilities in a matter of days and weeks rather than months and years. Additionally, banks will engage in extensive collaboration with partners who are not banks to provide new value propositions which are incorporated across customer experiences, technological systems, and data sets.

Unlocking the Competitive Potential of the Future

These important trends and technologies are increasingly interconnected and incorporated, which is providing a huge incentive for fintech and innovative thinking in the financial sector. It is currently a specialized financial niche. Sub-sectors are among the most proficient at capitalizing on technological developments to release applications, create revenue, and frame the nature of competition. In the long term, conventional banking organizations will have to make full use of the substantial resources available to them to keep pace with the rising tide of disruption sweeping through the financial industry.